Authors: Matthew Wahlrab and Craig Rochester

Companies of a certain size often struggle to make further breakthroughs after initial success in the market. At first glance, this seems mystifying: Revenue is in the high hundreds of millions of dollars to low billions. Tranches are publicly traded. Work quality is excellent and debts are well-managed. Yet a lack of attention from the press, investors, and corporate analysts is stunting growth.

For these companies, the solution lies in strategically shaking up their market, accessing the innovation they need to grow without exposing themselves to undue risk. This paves the way to move from mid-tier stasis to sector dominance.

From theory to hard data:

Building our corporate development analysis model

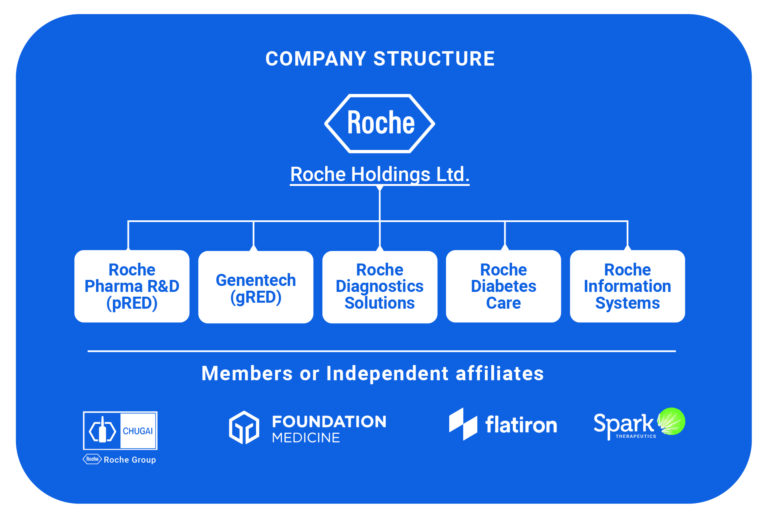

The Rapid Alpha team had a hunch that companies that diversified their toolset for improved innovation access were the ones blazing this trail to sector dominance. To back our theory up, we created a case study report on Roche, analyzing the multiple methods Roche used to access innovation that catapulted the former mid-tier pharmaceutical company to the top of its market.

Exploring wide-ranging data sets enabled us to map Roche’s innovation access approaches, quantifying their dizzying growth trajectory and blended strategy of building, partnering, and buying innovations.

Now, we’re offering this analysis model to mid-tier companies looking for similar game-changing corporate growth. Mapping your and your sector’s innovation landscape to identify the internal builds you can fund, the partnership opportunities open to you, and the buys you can afford, as well as the risk mitigation strategies you can build into each strategic strand.

Below, we’re introducing this offering with a brief take on the findings of our Roche Report, alongside guidance on identifying corporate development opportunities for your own company.

Overview: Our Roche Report on corporate growth

The Rapid Alpha team created the Roche Report to study Roche’s leap from eleventh to first place in prescription pharmaceutical sales in just 20 years.

Roche’s 20-year upward trajectory:

- 25% increase in revenue, from 45-46 billion Swiss francs to 56.8 billion

- 47% increase in market capitalization, from 140 billion Swiss francs to 207 billion

- 20% increase in earnings per share, from 10% to 18%

Are you in a company with a drive for this kind of growth?

Get in touch with us to discuss beta partnership opportunities.

For Roche, the numbers involved are fascinating. On one hand, in the pharmaceutical industry, the standard success rate for new molecular entities to launch as drugs is just 4%. Roche was able to dominate the market by doubling this percentage to 8%.

On the other hand, during its rise to the top, Roche’s three top-selling prescription drugs went off-patent. Normally, that would entail losing some 40-65% of revenue as generics flood the market. However, Roche was able to build its development pipeline so well that the company not only offset the revenue declines from these patent expirations but also grow new revenue streams faster than these declines.

Roche’s corporate development strategy: High risk, high reward

Our analysis of Roche’s patents, financial reports, and clinical trials revealed that Roche takes a surprisingly high-risk approach to innovation.

3:1 ratio of disruptive to incremental innovation: Far from prioritizing funding low-risk incremental improvements to existing compounds, Roche invested heavily not just in disruptive innovation of new compounds — of which, as noted above, just 4% succeed on average in the sector — but also specifically in Phase 1 of these new compounds’ development, the phase with the highest potential for failure.

Focus on high-risk treatment areas: Roche prioritizes investing in oncology, a therapeutic area known for its difficulty in getting new compounds approved.

Managing innovation investment risk: Roche adds strategic layers to its investments, multiplying its shots on goal; it is also successful in evergreening its patents. For every new molecular entity created, we found that the company created 7.5 new opportunities for regulatory approval, either through treating multiple indications or devising new ways of delivering the compound. Roche also strategically increased patent coverage for its prescription pharmaceuticals, in one instance extending 19 years beyond a patent’s average 20-year term. This blocked generics by finding a way to patent the new indications, treatments, and delivery methods for the compound, using patent extensions to increase the number of years with predictable prescription drug sales.

Build, partner, buy:

Obtaining technology for market-dominating corporate growth

The Roche Report revealed a 6:3:1 ratio across the company’s dominant innovation access strategies: Build, partner, and buy.

Building uses internal resources to shepherd compounds through clinical trials. Risk is high, with Roche incurring all expenses, but success isn’t shared.

Partnering mitigates risk, joining forces with industry players with existing patent filings for a compound. Roche becomes a development sponsor, rather than the initial owner of the technology, often with an option for exclusive licensing for successful compounds. Roche’s initial investment is limited and their only cost is cash, rather than the time and minds of the best and brightest within the Roche empire.

Buying sees Roche purchasing a competitor’s patents, rarely yet effectively.

How to start finding your own corporate development opportunities

1.Understand your company’s appetite and need for risk

Shaping a corporate development strategy begins with hard questions: Are you heavily leveraged on debt? Dealing with a business decline? Factors such as these will influence your risk appetite; while perhaps being naturally risk-averse, a company being eaten alive is forced into higher-risk activities.

Then we consider necessity: Are you a company that is willing to go all-in on highly disruptive concepts? Or are you only comfortable with funding incremental improvements when it comes to innovation? For Roche, striking a 3:1 ratio of disruptive to incremental seems key to their market dominance trajectory.

2.Understand your industry innovation success rate

Awareness of the innovation success rate that is standard in your sector enables you to set aims, benchmark your success, and evaluate the costs associated with the different approaches to acquiring new technology.

From there, you can strategize to enhance your ability to access innovation based on your financial and human resources — even if this means confirming that partnerships are your only viable path ahead.

3. Understand what a good portfolio mix looks like for you

How can you de-risk your investments with a strategic mix of build, partner, and buy? Grasping the inherent risk of an all-in opportunity failing enables you to strategize other bites at the apple that you may need to salvage that investment, turning it into an asset your company can still use to win market share.

Shape your innovation growth strategy with Rapid Alpha

Are you interested in getting this level of analysis for your own company? Rapid Alpha is seeking beta partners looking to dissect their industry standing and innovation pipelines: Identifying growth opportunities, re-engineering their product roadmap, and honing the ideal ratio and risk balance for their innovation access strategies.

Hello Matthew,

While I was a already aware of some of the points you made here, I learned a few more I from the Roche case study.

That said, I’d enjoy reading the rest of the Roche story!

Finally, if you haven’t already do so, please send a copy to Martin… I’m sure that this would spur a fantastic discussion at Thursday’s meeting.

Regards,

Rich McDonnell

ATEC, LLC

Will do, Rich. Thank you for your comment and suggestion.